Introduction

To put myself in your shoes, running a startup requires great effort in juggling finances with one’s ambition of success. Believe me, I have been there! From chasing receipts to understanding the plight of cash flows, accounting can sometimes appear as an incomplete jigsaw puzzle. Thus, when I stumbled upon Puzzle.io, the all-in-one accounting software for new-age startups like mine, I was a happy camper.

Here’s more about why Puzzle.io is a great, versatile approach to all loans, financial services, and financing for a startup.

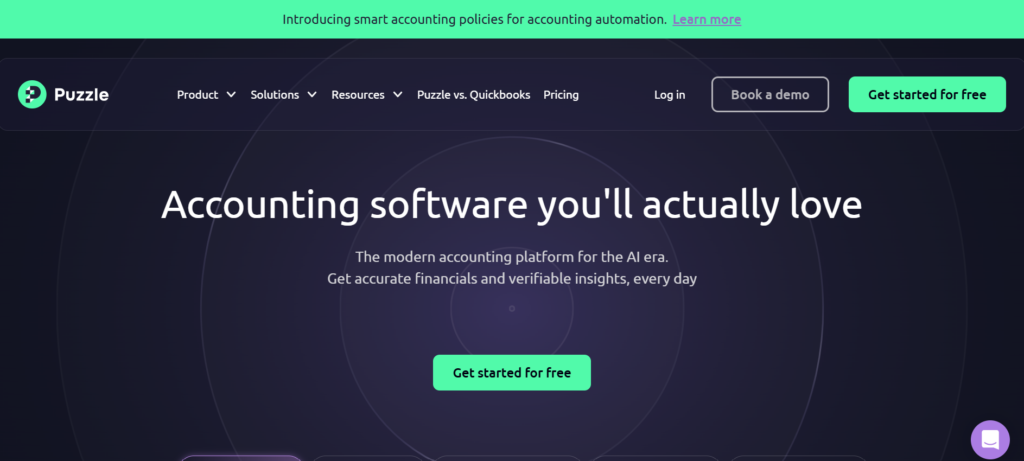

What is Puzzle.io?

Puzzle.io is an innovative accounting software specifically designed for startups. Whether If a business is self-funded or working to acquire funding, Cloud-based accounting software will allow it to track its financial performance in real-time.

Perform bookkeeping and accounting tasks, which would take hours otherwise, within minutes.

Be always ready for funding, loans, and any financial services with clean and easily readable financial information.

This tool has been a godsend for someone like me who isn’t an accountant but still wants to stay on top of business finances.

Why Startups Need Puzzle.io

As a founder, I’ve learned firsthand that managing financial affairs for a startup isn’t merely about keeping a record of expenses; it’s a means to gain insight into the numbers, which allows one to make better and wiser choices. This is what Puzzle.io provides:

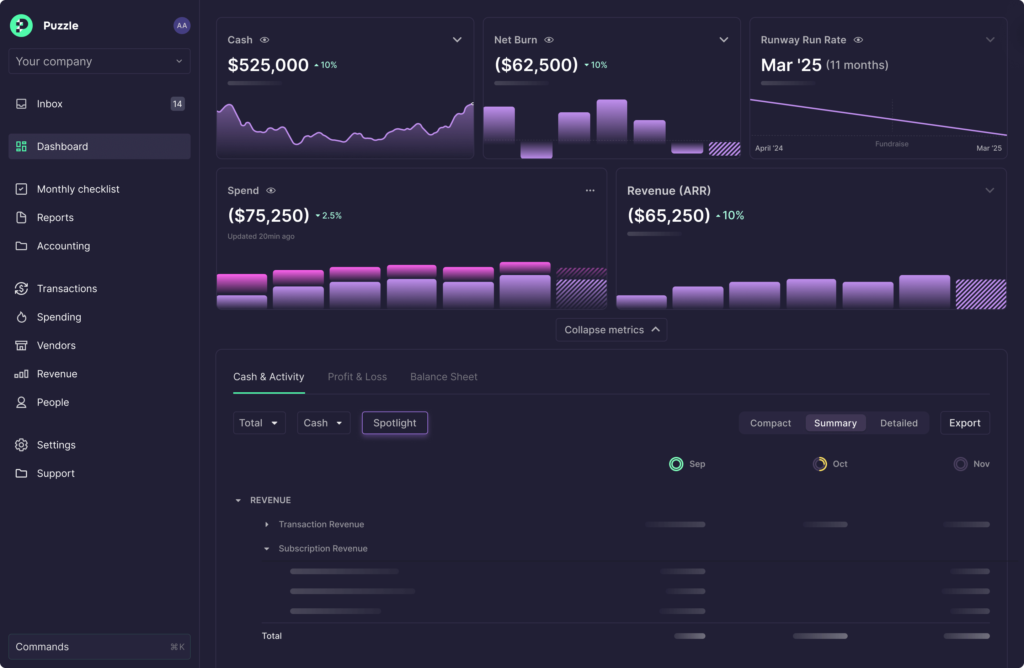

1 – Real-Time Accounting for Startups

Unlike traditional accounting software managing the books of the rather old-fashioned type, Puzzle.io connects safely to your bank accounts and instantly updates these. You don’t have to guess anymore-a view into your income and expenses is there, right in front of you.

2- Seamless Loans & Financial Services Integration

If you’re studying loans and financial services in a bid to grow your startup, then correct and up-to-date financial statements are what you need. Puzzle.io makes it very easy:

1 – Generate professional balance sheets and profit-and-loss statements;

2 – Keep track of verification, spread-your-financial-health to get some cash from lenders or investors;

3 – Streamline the loan application process with clean and structured data.

This was incredibly helpful for me when I went for a small business loan to scale my company. Puzzle.io made my startup’s finances look strong and properly prepared for investors.

3. Insights That Drive Growth

What differentiates Puzzle.io is that it produces actionable financial insight. For example:

1 – Cash Flow Analysis: Helps you understand where money is coming from and where it’s going.

2 – Revenue Trends: Allows you to identify growth opportunities and tweak your strategy.

These insights have armed me with the confidence to make data-backed decisions that brought my startup into regret.

Getting Started with Puzzle.io

There is no need to worry if you are new to accounting tools; getting started with Puzzle.io should not be difficult. Here follows how I got started:

1 – Sign Up: Create an account in minutes.

2 – Connect Bank Accounts: Get Puzzle.io to connect with your real-time data accounts.

3 – Start Tracking: Keep track of transactions; prepare financial reports; get a loan in place and more!

The interface is clean, intuitive, and quenches the thirst for founders without an accounting background.

Why I Recommend Puzzle.io

Having had the experience of using Puzzle.io for my startup’s finances, I can sincerely say that it is one of the best investments I have made. This is because:

1 – Saves time: Less time on numbers, more time on growing my business.

2 – Accordingly, lenders and investors loved the crisp, detailed reports I could whip up with a few clicks.

3 – Startup-centric: This means it was built for start-ups like mine, very flexible, scalable, and easy to u.

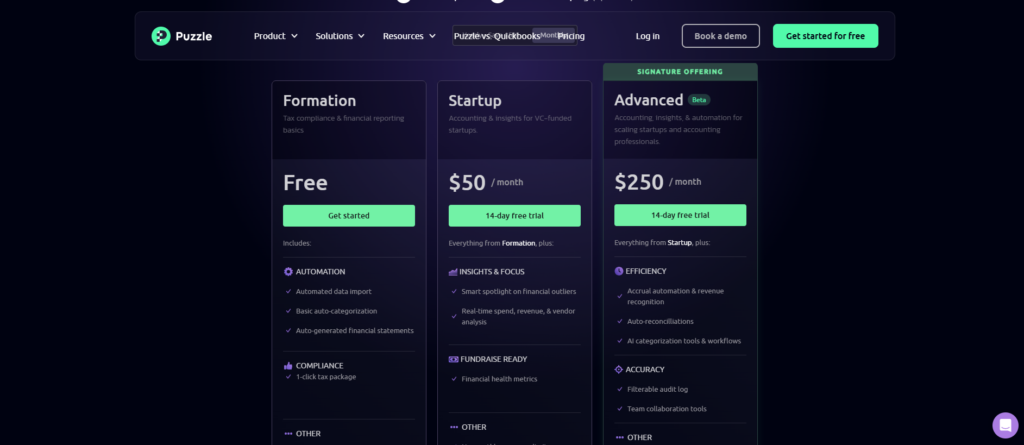

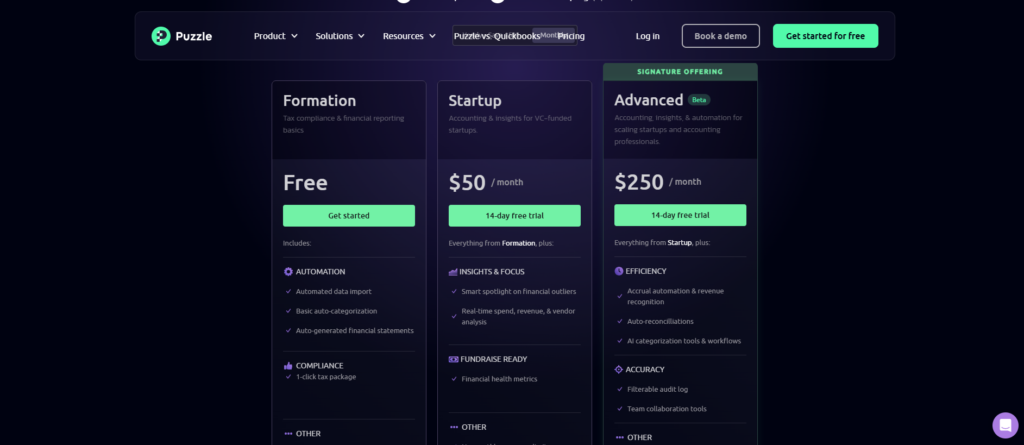

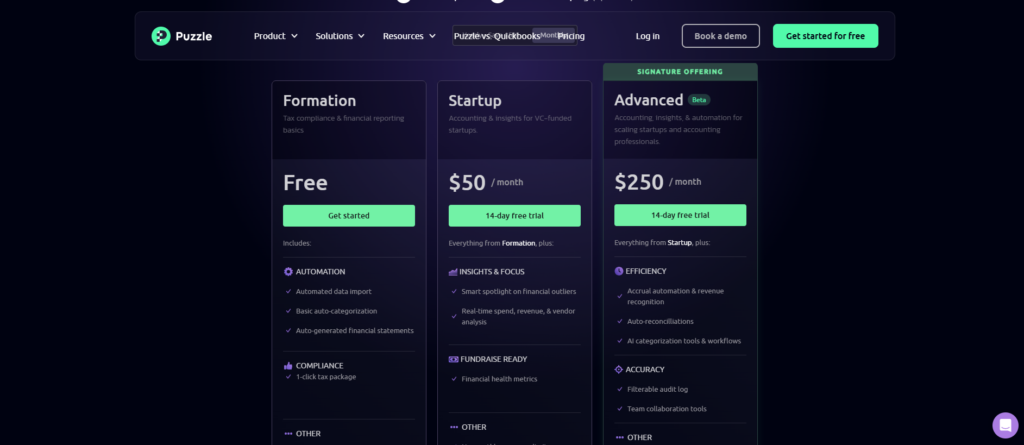

Puzzle.io Pricing: A Solution for Any Stage Startup

Effective financial management is at the heart of any startup’s success. As good as Puzzle.io is in simplifying your accounting and financial management, so is its pricing model, crafted to fit within the budget and needs of a startup at every growth stage. Let’s go into detail about how much Puzzle.io costs and why it’s worth every penny for your startup.

Why Pricing Matters for Startups

Startups must operate on a shoestring budget and carefully make investments. Overinvest in a tool, and that growth will be hurt; underinvest, and inefficiency is sure to follow. Puzzle.io finds the happy medium with affordable yet full-featured plans.

Puzzle.io Pricing Tiers

1 – Starter Plan – $15/month

Perfect for startups and solopreneurs of the early stages.

Features:

- Real-time bank account integration

- Automated bookkeeping and reporting

- Basic financial insights and analytics

- Who it’s for: Founders who seek a pocket-friendly solution for keeping themselves abreast of their finances without a background in accounting.

2 – Growth Plan – $49/month

Made for those startups scaling their business and ready for greater financial insights.

Features:

- All Starter Plan features

- Advanced reporting tools (customizable balance sheets and P&L statements)

- Cash flow forecasting

- Priority support

- Who it’s for: Startups preparing for investment as their operational expansion may be financially complicated.

3 – Enterprise Plan – Custom Pricing

Perfect for larger startups or those with unique financial management needs.

Features:

- All Growth Plan features

- Customized onboarding and training

- Dedicated account manager

- Custom integrations and advanced analytics

- Who it’s for: Established startups that need tailored solutions to accommodate their intricate financial workflows.

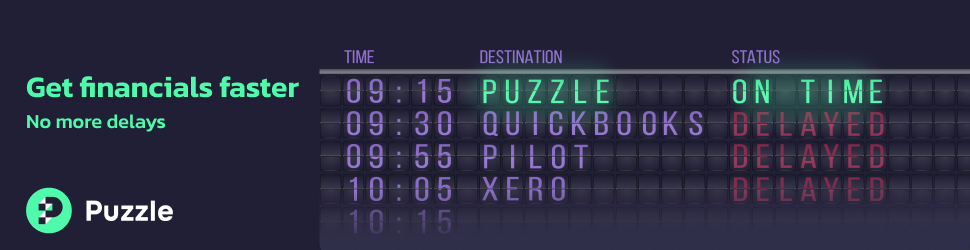

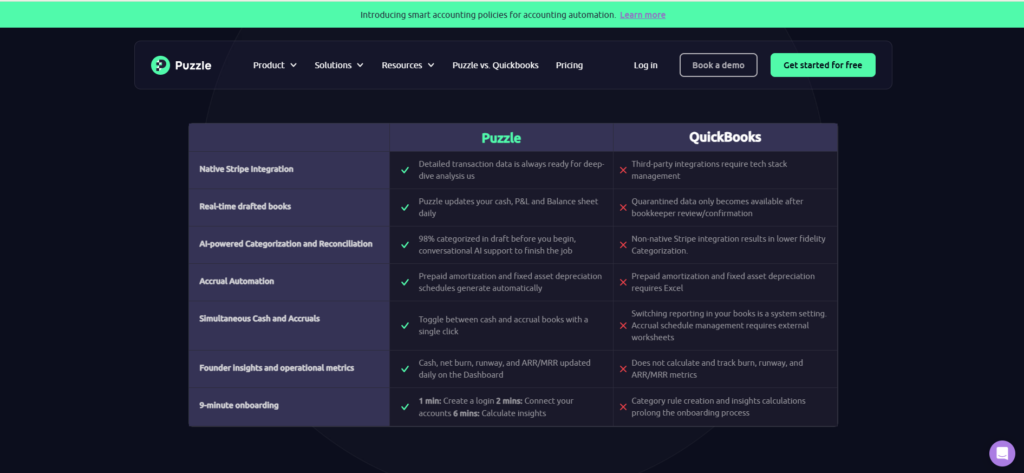

Puzzle.io vs. QuickBooks: Which Is Better for Startups?

However, the comparison between Puzzle.io and QuickBooks often stands out. They have excellent accounting solutions, although they cater to slightly different audiences and needs. Here is a broader picture that might help you decide on one for your startup.

1. Target Audience

- Puzzle.io:

Puzzle.io is designed with small businesses and startups in mind. This includes the most basic real-time tracking, simplicity, and readiness for funding, loans, and financial services. It is most amenable for a founder with little or no deep knowledge of accounting.

- QuickBooks:

QuickBooks is a generic small-to-medium business accounting software that caters to SMEs across varying industries. It has comparatively broader features but may be less startup-centric.

2. Ease of Use

- A simple, clean user experience suitable for non-accountants.

- very low learning curve—just right for a founder who manages his finances alone.

- Concentrating on automating tasks to free up time.

- QuickBooks:

- A little more learning curve, wide-ranging features.

- General accountants or business owners with a little financial knowledge.

- Advanced features may lead to confusion for beginners.

3. Pricing

- The starting price tiers are $15/month for Starter and $49/month for Growth.

- It is specifically designed for startups on tight budgets.

- Try our free trial.

- QuickBooks:

- Plans start from $25/month to $180/month for advanced features.

- Will include features that startups do not necessarily want or may even use beyond basic features.

4. Customer Support

- Places importance on startup-specific questions with personalized assistance.

- Dedicated onboarding for higher-level plans.

- QuickBooks:

- Providing wide-ranging support without a particular focus on startups.

- Greatly depends on the use of community forums and online documentation.

Final Thoughts

If you are really ambitious regarding creating a startup and looking for better ways to manage your finances, this is worth it. The tool covers regular day-to-day accounting with help preparing loans and financial services, easing you up to focus on what matters: growing your startup.

Are you ready to manage your startup finances? Give it a shot and never turn back! 🚀

So, have you actually used Puzzle.io or are you thinking about giving it a go? Let me know your views in the comments-Since I would love to hear from you! 😊